do you have to pay taxes on inheritance in tennessee

This is a term that describes any tax one may encounter when receiving an inheritance. People who inherit property arent eligible for any capital gains tax exclusions.

Tennessee Estate Tax Everything You Need To Know Smartasset

Who has to pay.

. Inheritance tax rates differ by the state. Even though Tennessee does not have an inheritance tax other states do. It is one of 38 states with no estate tax.

So do you pay taxes on inheritance. Until that time estate. Be aware of that your assets located in other states may be subject to that localitys inheritance.

There are NO Tennessee Inheritance Tax. If you receive property in an inheritance you wont owe any federal tax. The Only Company That Actually Gets You Your Inheritance Money in 24 Hours.

Gift and Generation-Skipping Transfer Tax Return. Just like any home. Tennessee does not have an estate tax.

First youll need to get the home rental-ready. Here are the frequently asked questions about Tennessees inheritance tax. Thats because federal law doesnt charge.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state. Even though Tennessee does not have an inheritance tax other states do. More importantly people are looking to understand when taxes apply and when people do not have to pay them.

The inheritance tax applies to money and assets after distribution to a persons heirs. This gift-tax limit does not refer to the total amount you. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have.

Tennessee has updated its tax. Estate taxes will be levied in 2021 on estates worth. Depending on whether or not youve prepared a valid will at the time of your death Tennessee inheritance laws surrounding your estate will vary wildly.

The inheritance tax is a tax charged to the recipient of the estate. It allows every Tennessee resident to reduce the taxable part of their. All inheritance are exempt in the State of Tennessee.

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. There is no federal inheritance tax. Ad Use Probate Advance to Get Your Inheritance Now.

Ad Use Probate Advance to Get Your Inheritance Now. Then factor in costs like 247 maintenance support property management and tenant gaps. Up to 25 cash back Update.

Inheritances that fall below these exemption amounts arent subject to the tax. How do inheritances get assessed for tax purposes. The first rule is simple.

All inheritance are exempt in the State of. If the value of the gross estate is below the exemption allowed for the year of death. Therefore you would have to pay tax on the 10000 gain.

Tennessee will require the executor of an estate. There are NO Tennessee Inheritance Tax. Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301.

These states have an inheritance tax. The net estate is the fair market value of all. Its Fast Easy with No Hidden Fees.

Other than the Inheritance and Estate taxes there are other taxes that you. In 2012 Tennessee passed a law to phase out the estate or inheritance tax over time. The federal government does not have an inheritance tax.

The federal government does not tax inheritance taxes which is the tax on the value of an individuals estate. This tax is only charged by 6 states. In 2016 the inheritance tax will be completely repealed.

If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax. Tennessee used to impose its own estate tax which it called an inheritance tax This tax ended on December 31 2015. Whether or not you have to pay inheritance tax depends on the state you live in the size of the inheritance and.

Tennessee Inheritance and Gift Tax. The inheritance tax is different from the estate tax. At the federal level there is no tax on.

If the total Estate asset property cash etc is over 5430000 it is. However taxes can be a complicated subject. Its Fast Easy with No Hidden Fees.

As of 2021 the six states that charge an inheritance tax are. An inheritance tax is a tax on the property you receive from the decedent. Also in this case you need to file Form 709.

For deaths occurring in 2016 or. Whether or not you have to pay inheritance tax depends on the state you live in the size of the inheritance and your relation to the deceased. The Only Company That Actually Gets You Your Inheritance Money in 24 Hours.

The annual exemption limit for 2022 is 16000 This means that there is no tax on gifts that do not exceed this amount.

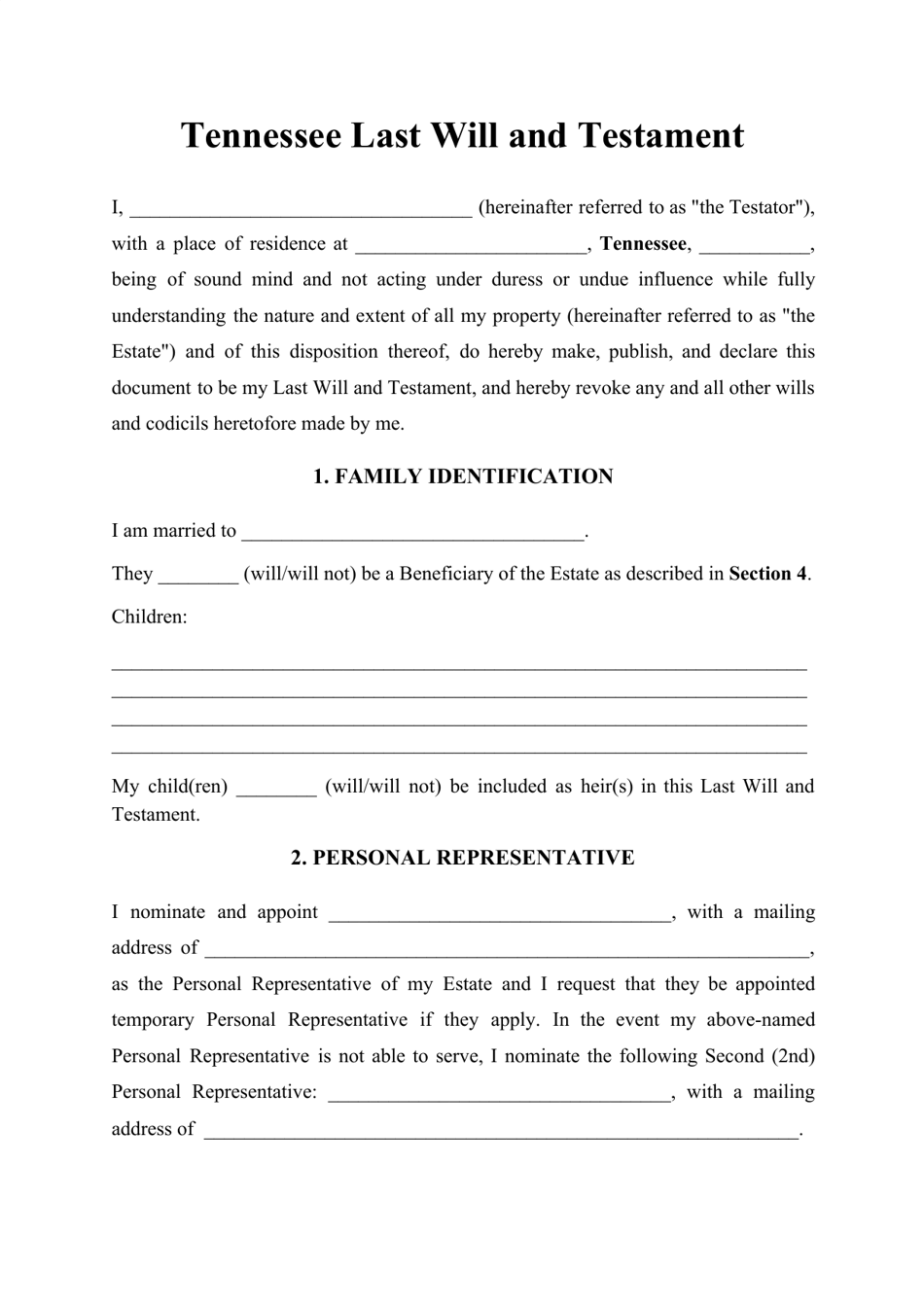

What You Need To Know About Tennessee Will Laws

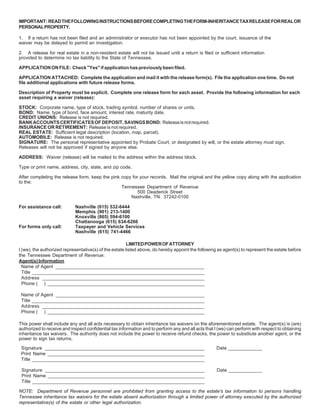

Tennessee Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Tennessee Estate Tax Everything You Need To Know Smartasset

How To Get A Marriage License In Tennessee Zola Expert Wedding Advice

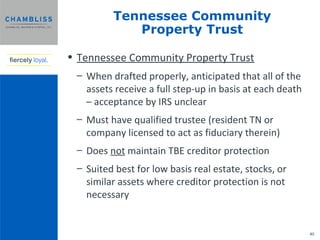

Chambliss 2014 Estate Planning Seminar Pptx

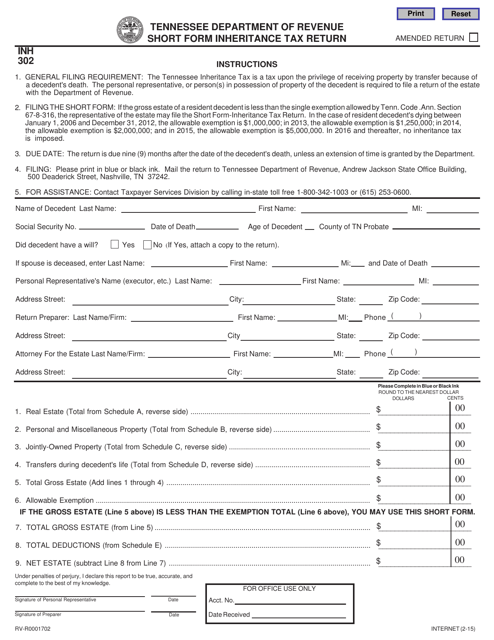

Form Rv R0001702 Inh302 Download Fillable Pdf Or Fill Online State Inheritance Tax Return Short Form Tennessee Templateroller

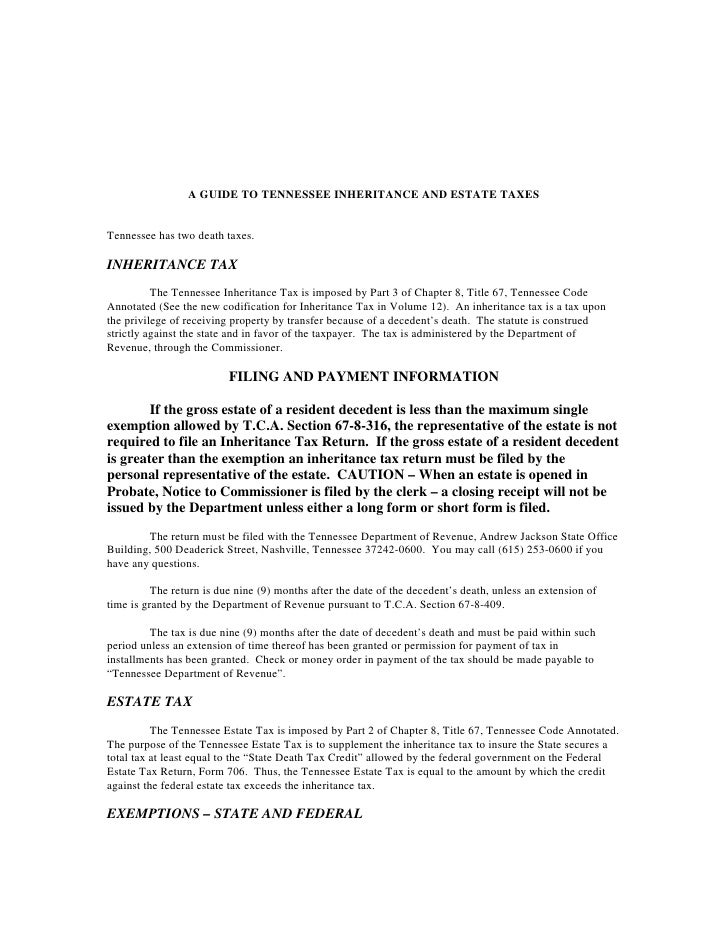

A Guide To Tennessee Inheritance And Estate Taxes

There Are Several Types Of Power Of Attorney To Consider When Planning Your Estate Contact An Experien In 2022 Estate Planning Attorney Legal Services Estate Planning

Tennessee Estate Tax Everything You Need To Know Smartasset

Chambliss 2014 Estate Planning Seminar Pptx

Tennessee Health Legal And End Of Life Resources Everplans

Fill In State Inheritance Tax Return Short Form

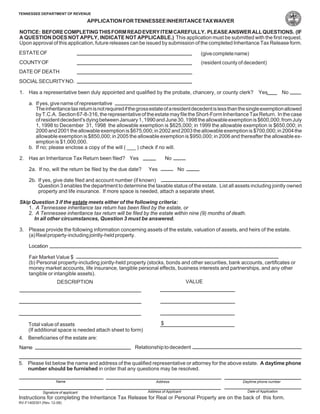

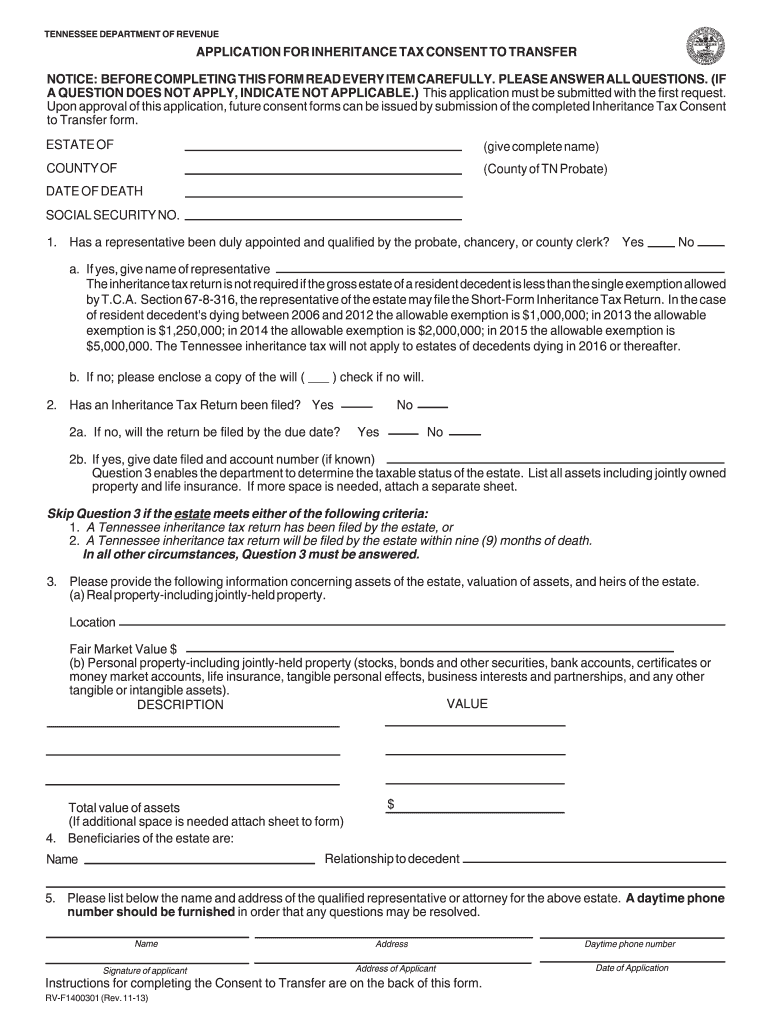

2013 2022 Form Tn Rv F1400301 Fill Online Printable Fillable Blank Pdffiller

A Guide To Tennessee Inheritance And Estate Taxes

Divorce Laws In Tennessee 2022 Guide Survive Divorce

Tennessee Last Will And Testament Template Download Printable Pdf Templateroller

Where S My Tennessee State Tax Refund Taxact Blog

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax